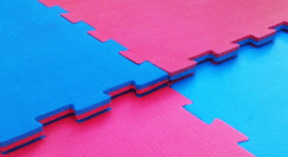

New Stock of Interlocking EVA Jigsaw Mats

We just had a new shipment of EVA interlocking jigsaw mats arrive yesterday. The mats have been unloaded and ready to go. The 40′ container arrived with an assortment of mats including 20mm mats, 30mm mats and 40mm mats. The mats are red and blue just like our existing range. We are also looking to bring in black and grey mats with our next shipment.

Ezymats interlocking EVA jigsaw mats are ideal for a number of applications including cross-training, gyms, aerobics, children’s play areas, judo, karate, MMA, jiu-jutsu and other martial arts. They are easy to store and the unique jigsaw design makes them easy to install.

Our interlocking EVA jigsaw mats start from only $15.00 per square meter and are the cheapest jigsaw mats on the market. The mats can either be picked up from our warehouse in Belmore NSW or they can be shipped Australia-wide. Contact us today for your order.

Follow us: