Market Watch

Share markets from Asia to the US slumped last week on the back of credit risk aversion and disappointing earnings. The Dow Jones lost its YTD gains in one session and the S&P 500 shed 2.3% in recording its worst week since 2012.

The ASX dropped 1.36% on Friday to close at 5556 after hitting a 6 year high earlier on in the week. UK and European shares lost ground in the wake of a lower than forecast manufacturing data reading from China.

Gold rose by 0.9% on Friday to close at $1294/oz after a disappointing jobs report from the US. More on that in the USD section below.

Oil saw its biggest weekly drop in seven months after the refinery utilisation rate dropped for the first time in 5 weeks. WTI finish 0.3% lower at $97.88/bbl.

The AUD lost close to 1% last week as economic data was softer than expected, disappointing investors after a largely positive previous week. Building Approvals dropped 5%m/m and the Producer Price Index fell 0.1%, just the second negative reading in four and a half years. This lower than expected inflation gauge opens the way for a further rate cut should Glenn Stevens deem it necessary. Retail Sales data released today ahead of the RBA meeting tomorrow should provide some interesting reading.

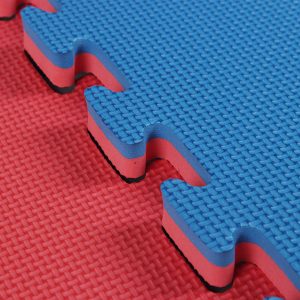

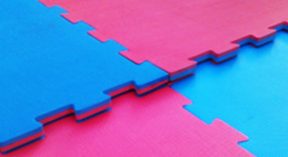

The price of EVA jigsaw rubber gym mats is stable. Ezymats is still the market leader both in Australia and globally though their China office.

Follow us: