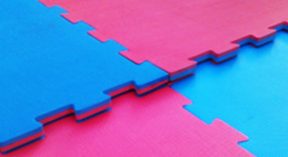

Shipment Arriving Monday

Our new shipment of jigsaw mats arrive on 26th May. We have a full container of 40mm jigsaw mats. About a quarter of the container has be pre-purchased. Call now to reserve your mats.

Our new shipment of jigsaw mats arrive on 26th May. We have a full container of 40mm jigsaw mats. About a quarter of the container has be pre-purchased. Call now to reserve your mats.

The S&P500 rallied 0.81% overnight erasing yesterday’s declines as the FOMC Meeting Minutes continued its dovish rhetoric and said continued stimulus would not risk sparking a jump in the inflation rate. Inflation is expected to remain within its 2 percent goal. Policy makers continued to say that last month the economy is showing signs of improvement and the job market is slowly picking up.

Further reduction in the monthly bond purchase program is likely to continue and they re-iterated that interest rates will remain on hold for a ‘considerable time’ once it concludes the purchase program. U.S 10-year notes yields rallied 0.85% on the back of the positive FOMC announcement, the yield gap between 5 and 30 year Treasuries widening to the highest level in a month.

Gold futures declined 0.50% as traders saw less need for the save haven metal once the FOMC announced there was no threat of inflation.

WTI crude rose to a one-month high after a government report showed that stockpiles tumbled last week as imports dropped to a 17 year low.

Ezymats has continued to improve the e-commerce website for the benefit of their customers. The content has been improved recently to better explain jigsaw mats to customer and improve community knowledge. Also the range of jigsaw mats as been expanded to include 20mm jigsaw mats, 30mm jigsaw mats and tatami vinyl mats.

The posted its first back to back loss this month yesterday and fell against all the other majors after the RBA statement release. The daily decline of 1% was the largest since February as the AUD succumbed volatility and fear for the first time in 2 months. Local data coming out today includes Westpac consumer sentiment survey and wage price index for the March quarter from the Australian Bureau of Statistics.

The decline in the AUD shouldn’t have an impact on imported goods such as jigsaw mats in the short term. Should it persist or even go lower there could be an impact. For jigsaw mats already on the high seas there will be no change in pricing. In any case Ezymats will remain the supplier of the cheapest and best jigsaw mats on the market.

Place your order for jigsaw mats today. We have a new shipment of 40mm jigsaw mats arriving on the 22nd May. Customers have already re-ordered but we still have some available.

If you miss out on this shipment don’t worry. We have new shipment arriving all the time.

Overview of the Markets

The majority of European and American Equity markets finished in the green with only modest gains as the Dow Jones Industrial Average closed 0.27% at 16,491.31, just shy of historical highs. The NASDAQ and S&P 500 also rose 0.52% & 0.37% respectively. The markets rallied on the back of further signs the world’s largest economy is still improving as US building permits rose to 1.08m over the 1.01m forecast.

Gold remained relatively unchanged with only a $0.20 decline to close the week at US$1,293.40 while WTI Crude Oil jumped $0.52 up to $102.02 a barrel.

Elsewhere tension are still at boiling point in the Ukraine as Civil War starts to look more and more likely with fighting continues to rage as we draw closer to the May 25th presidential elections.

The AUD finished up for the third straight week and continued its push for a fourth straight month of gains, the longest rally in 4 years for the Aussie currency. With the absence of any major data on Friday the AUD drifted within a tight range to close almost unchanged. With a relatively quiet week locally.

Jigsaw mats pricing remains stable. They will remain so as long as the dollar is strong. It has been consistently been trading above $0.93USD. The 40mm jigsaw mat pricing is between $25.00 and $30.00 per mat depending on pricing.

In local markets yesterday, there was little in the way of economic data releases although the fallout from the budget continues as opposition governments vow to block reforms citing a “budget built on lies” however the budget projections have had minimal impact on the markets thus far.

Across US markets yesterday it was another positive day with PPI, CPI, Philly Fed Manufacturing numbers and Unemployment claims all outperforming expectations. PPI figures, released overnight on Wednesday showed that prices have increased by 0.6% against an anticipated 0.2%. CPI data showed growth at 0.3% which is the biggest gain since June 2013 and unemployment claims fell to the lowest level since May 2007. The Philly Fed continued its recent run of form posting the third consecutive outperform with a 15.4 reading against the anticipated 13.9.

In Europe, data continues to disappoint with CPI numbers as expected but well short of the ECB target inflation of 1% Italian GDP actually showed a contraction of 0.1% against an expected gain of 0.2% although Germany outperformed slightly with 0.8% gain against a 0.7% expectation. The continued sluggish growth in the region coupled with ongoing tensions in the Ukraine has given rise to speculation of potential interest rate cuts by the ECB to negative territory or a possible QE program as adopted by the US and UK. The announcement of their next move is expected on 5th June.

Elsewhere tensions continue to rise between Russia and the Ukraine with the Ukraine pushing on with operations to remove separatists from eastern borders. If Russia was to disrupt elections in the Ukraine, the US and other allied forces would impose further sanctions on Russia, already suffering from slower growth as a result of current sanctions.

No local data today but the Chinese Foreign Direct Investment number out at lunchtime might spark some much needed movement. The number, which represents the total investment capital made by foreign enterprises, economic organizations and individuals, above the previous read of 5.5% could see a boost for the Aussie in afternoon trading.

Yatama Technology has introduced a new range of Emergency jump start power banks. The new kit include a power bank and jumper cable which allow a user to jump start there car if the battery is flat. The new devise is great for people in a hurry or those who don’t have a mobile car service like NRMA. No more waiting for a jump start in the middle of the night. Just pull out your emergency jump starter kit and start your engine.

Kits start from 9000mAh and go up to 13,000mAh. The power bank can also charge mobile phones and other portable devises like GPS.

A 71-year-old Bosnian retiree has built a Volkswagen Beetle almost entirely out of wood. The project took Momir Bojic two years to complete in his garden workshop. Mr. Bojic used more than 50,000 pieces of oak to build the car, which is drivable.

WTI Oil rose to a three week high as government report showed stockpiles fell 592,000 barrels last week and US gasoline demand increased to six month highs. Gold rose to a one week high as mounting political unrest in Ukraine boosted demand for the metal as a safe haven asset.

US stocks fell from all-time highs sending benchmark indexes down from all-time highs as investors resumed selling in small cap and internet shares as company’s earnings were scrutinized. The S&P500 fell 0.50 percent after climbing above 1900 for the first time yesterday.

Yesterday’s trading session saw the Aussie Dollar make a short rally to test April’s highs coming from increased speculation the RBA will raise interest rates later this year. This fuelled more risk appetite buying and drove the market almost 50 points higher. However this was short lived as the overnight session managed to subdue this enthusiasm and we are now trading near yesterday’s open.

Overnight the main market mover was the US Dollar falling against a basket of major currencies for the first time in four days as Treasury yields declined on speculation the ECB will introduce easing measures to boost the EU economy by next month. The Euro slowed its recent selling as traders started to take profits following a solid week of selling waiting for further confirmation from tonight’s European Inflation numbers out of France and Germany.

The Greenback saw a better than expected PPI m/m number coming in at 0.6% compared to a forecast of 0.2%. This is a good indicator of consumer inflation, as this shows that when producers charge more for goods and services that the higher costs tend to be passed on the consumer. The market will be looking at Core CPI, Unemployment Claims and Philly Fed Manufacturing Index data tonight to see movements against the Aussie.

The jigsaw mats market is stable at the moment. There is sufficient supply even though demand is currently high. There continues to be demand from a broad range of users. May will see the arrival of yet another shipment of 40mm jigsaw mats for Ezymats. There is also talk of other thicknesses like 20mm and 300 and a high likelihood of vinyl mats hitting the market.

Copyright © 2025 Ezy Mats. All Rights Reserved

| There are no products |

Follow us: