Market Watch Gym Matts and Gym Matting

It is that time of the week to see how the markets are going. That is why we having “Market Watch Gym Matts and Gym Matting“. There has been a lot of volatility in the markets lately. For the first time it can not be blamed on either Donald Trump or his trade war with China. This time the volatility can be blamed on fluctuating commodity prices and under-performing bank stocks. These are just business management issues and supply and demand issues.

Issues Effecting Gym Matts & Gym Matting

They are the same issues that effect all markets, including the markets for Gym Matting and Gym Matts. In fact gym matts are like the canary in the coal mine when it comes to the health of the economy. When people feel good or want to feel good about themselves they buy more mats. When they no longer feel good about themselves they generally buy less gym matts. This is especially true if their financial health has been effected in some way.

The Effect of AUD on The Market

From a local economy perspective another good indicator of how good we are doing is the AUD or Australian Dollar. If the dollar is doing good then you can assume that the economy is also doing good. If it is doing bad then the vice versa can be assumed. So if you look at the AUD vs USD, it fell for the seventh time in eight days since hitting a four month high last week. This would be indicative of negative sentiment towards the AUD due to lost confidence in the economy.

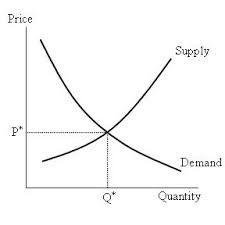

Usually if things are looking up then money floods the market. This is because investors think that interest rates will go up thus increasing their return. It becomes like a supply and demand thing where more people want to buy something which is intrinsically in short supply. This is just the same with gym matts and gym matting.

Look at for our next report on “Market Watch Gym Matts and Gym Matting” to find out how things are going.

Follow us: