China’s State Administration of Taxation Reform

China’s State Administration of Taxation (“SAT”) put into effect on broadening the scope of tax benefit for Small-medium sized Enterprises

In its official website, China’s SAT issued a bulletin on 18 April 2014 (Caishui [2014] No.34) that all the Small-medium sized Enterprises, in compliance with specified conditions, may enjoy the tax benefit on Corporate Income Tax (“CIT”). The relevant main terms are extracted as follows:-

1. The Small-medium sized Enterprises in compliance with specified conditions may enjoy a preferential tax rate of 20% on taxable income regarding CIT;

2. At the time of annual reporting of CIT, the preferential tax benefit policy will be adopted without the requirement of obtaining formal approval in advance from the competent tax authorities;

3. The Small-medium sized Enterprises with current and cumulative taxable income not exceeding RMB100,000, of which examining accounts is required and tax is imposed at a fixed rate, are applicable to this tax benefit policy;

4. Newly-established Small-medium sized Enterprises with the taxable income not exceeding RMB100,000 can also enjoy the said tax benefit as well

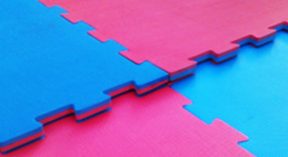

The measures will enable more Small-medium sized Enterprises to enjoy the tax benefit on CIT so as to release more liquid working capital for investing in future business development. This is sure to benefit EVA jigsaw mats and gym mats manufacturers. It will benefit the broader market for these and other products.

Follow us: