Croatian Economic Overview

The beginning of this year was marked by relatively favorable economic developments that have in the meantime faded and allowed for the return of recession. Although seasonally adjusted GDP increased by 0.3% in the first quarter compared to the fourth quarter of 2013, this encouraging upturn was not sufficient to compensate for a 0.7% drop in the previous quarter. Consequently, GDP level remained 0.4% lower than in the first quarter of the last year. The first quarter this year saw positive developments in personal consumption and exports, as well as in manufacturing. The most recent trends, however, are not that favorable. High-frequency indicators suggest that momentum in key sectors has gradually diminished (volume of retail trade, tax revenues) or turned negative (industrial production) increasing the probability of negative quarter-to quarter GDP growth in the second quarter of this year.

GDP growth in the first quarter was predominantly the result of a strong increase in personal consumption, which was, in seasonally adjusted terms, 0.8% higher compared to the fourth quarter of last year. In spite of such increase, personal consumption remained 0.5% below its level from a year before. Similarly to GDP developments, increase in the first quarter of 2014 appeared after a notable drop in the fourth quarter of 2013 and was insufficient to offset that loss.

In the last two quarters consumption has remained at the lowest level since mid-2004 confirming the depth and the persistence of the current recession in Croatia, which is in its sixth consecutive year. Positive developments in the first quarter were possibly caused by postponing household consumption from the end of the last year to the beginning of this year in the expectation of seasonal discounts. This strategy seems to have worked well as consumer prices dropped in January and February pushing annual inflation rates into negative territory. Nevertheless, personal consumption is still under the strong influence of reduced households’ disposable income, deleveraging, and low consumer confidence, which are all likely to prevent its sustainable recovery in the near term. For the first time since 2011 government consumption has experienced a more durable contraction. Seasonally adjusted consumption has declined for the last three quarters in a row allowing for a cumulative shortfall of 2.3%. In the first quarter, this decline was 0.7%. It appears that serious fiscal consolidation can no longer be postponed as financial constraints are getting tighter and government consumption, i.e. government expenditures on goods and services, should be reduced.

Investments have continued to disappoint. Seasonally adjusted figures for the first quarter indicate a drop of 0.4% vs. the fourth quarter of last year and a drop of 3.6% if compared to the first quarter of 2013.

Both exports and imports have substantially increased at the beginning of this year. National accounts statistics recorded that volume of exports of goods and services increased by 6.1% year-on-year in the first quarter, and volume of imports by 2.5%. Trade of goods rose even more strongly than total trade, while trade in services declined.

After exhibiting a strong growth in January, which allowed for a 4% rise in the first quarter this year compared to the last quarter of 2013, industrial activity started decelerating which has finally resulted in the negative trend.

Unemployment figures indicate an improvement in the second quarter of 2014. After a peak in February, the number of registered unemployed has been falling sharply to reach 305 thousand in June, which is 7% less than in May and 4% less than a year ago. Recent increase in employment has been much smaller than a decrease in unemployment, causing reduction in the active population. The active population has been declining ever since February 2013 and in May 2014 it was 2.3% lower than a year ago and 7% lower than in May 2008.

Consumer price inflation has continued to record negative year-on-year rates since February this year in spite of moderate increases on a month-to-month basis. However, June brought a negative monthly rate contributing to negative annual inflation rate of 0.4%. Deflation is caused mostly by lower import prices and very poor domestic demand. June figures show that majority of market-determined prices recorded a decline, such as prices of food, non- alcoholic beverages, clothing, footwear, furniture, communication and recreation. There are a number of items whose prices are either immune to poor domestic demand, such as tourist services, or are administratively controlled, such as health services or water supply, or are simply subject to increasing excise taxes, such as tobacco. Prices of these goods are steadily increasing.

Expectations

In spite of a more favorable international environment and opportunities opened by the EU membership, short-term economic prospects for Croatia have remained muted. After recording negligible GDP rise on quarter-to-quarter basis in the first quarter of 2014, high frequency indicators suggest that negative GDP rate might return in the second quarter. Strengthened demand from EU and CEFTA countries is expected to be overridden by weakened domestic demand and negative short-term effects from fiscal consolidation retaining our GDP projection at -0.5 percent for this year, while the next year should see a positive rate of 0.7 percent driven by recovery of exports and investments.

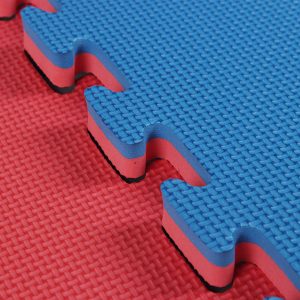

Whilst there are numerous judo, boxing, kick boxing, bjj and gymnastics organisations in Croatia. The market for jigsaw mats is not huge. Nonetheless Ezymats has the logistics to ship their EVA interlocking jigsaw mats to Croatia and Europe.

Follow us: